Student Loans Finished! Lessons Learned, The Cost Of Borrowing, & My Loan Forgiveness Thoughts

It's done.

We made it happen.

Our student loans are now paid off.

$154,771.83 In Ten Years.

- Base Loans: $95,993.38

- Capitalized Interest (while attending college): $13,028.59

- Accruing Interest (post graduation): $45,749.86

We’re incredibly grateful for the people, opportunities, lessons, and development that have been a part of this journey towards greater financial freedom in our life.

But, this complex journey comes with a bit of anguish.

Life is Hard. Business is Challenging. The World is Uncertain.

Leaders, freelancers, and entrepreneurs: Get stories & systems, for navigating the challenges, in your inbox.

To us, the below picture captures what if felt like paying off the loans (that's a pile of money burning). This feeling is not exclusive to student loan debt, but anything paid for an extended time after the purchase. It’s the unhealthy tension of getting something wayyyyy before we pay for it (and something we don't end up using).

This college and borrowing adventure for us has been a windy and unbeaten path. So much of it was unnecessary, misguided, and foolish. The acceptance of these mistakes and the consequences were essential to take responsibility for our choices and fulfill our obligations to move our lives forward (regardless of how others may have played a role in it).

One major regret for both Cait and my college education borrowing is how neither of our schoolings contributed to the success and ultimate repayment of our loans. She is a stay-at-home mom and I'm an entrepreneur doing things unrelated to my schooling. Our college education would have been more positive if our past decisions strategically aligned with the direction we made along life’s journey.

But, it’s not all bad and the end result is invited and valued. Many aspects of the journey contributed wonderful ingredients into our lives. And, it's been a solid process for developing the character of us both. As messy as it has been, it’s awesome to now have this burden untangled and resolved for a stronger and better future.

As we close this chapter of our lives, I've reflected on a variety of topics to garner the lessons learned and discover how we best apply them to the future. Here's where we're going for the remainder of this deep blog post debrief.

-

Why I Attended College

-

The Reality (Cost) Of Borrowing For A Higher Education

-

Our Journey To Pay Off Our Student Loans

-

How I'd Do It Differently Today

-

My Thoughts On Student Loan Forgiveness, Free College, And Aiding Our Kid’s College

For those wanting the highlights of the journey without reading my extensive insights, I’ve included a small teaser summary at the beginning of each section to give you a high-level view.

Let's get started with how and why this journey began in the first place.

Photo by Simon Fitall on Unsplash

Why I Attended College

Short Answer:

As a self-driven learner and problem solver, I wanted to skip college and go straight to doing the work I loved. But, to honor my father and the wisdom of counsel, I attended and completed college.

Long Answer:

After graduating from high school, I was done with school and didn’t want to go to college. My dad, uncle, and others jumped into the entrepreneurial track and didn’t need a college education to make it happen. I began freelancing right out of college for my uncle (working on an Emmy award-winning education program) and working a small eBay business. I saw school as a big distraction and shackles for my future of infinite possibilities.

So, why do something I didn’t want to do or didn’t see value?

To honor the request of my father and other mentors in my life. If he and others had not pushed me so hard to go and finish college, I probably would not have.

As my dad observed a young me, he noticed I would start and not finish projects. This was true, and it would later plague me in my small business journey. By starting and finishing college, I’d learn what it took to finish something I didn’t want to do while also learning along the way (or so he hoped).

While school contributed to the growth in me to overcome this pitfall, it didn't solve the problem. Embracing and repaying the loan (and my entrepreneurial journey) was actually a much larger contributor to this dynamic of not finishing what I started. Let me explain.

My original goal was to direct feature films. But, instead of going to a school and selecting a degree that would facilitate this (or even the business journey that would soon follow), I chose a degree (bachelor's of fine arts in media and animation) that would be the easiest for me to graduate. How could I sneak through to the end without too much additional effort (while I worked on the side doing what I actually wanted to do)?

It was quite similar to how I went through high school. And, during these high school years as a self-driven learner, I taught myself 3D animation (using Maya) while interning for my uncle’s small animation studio. During this time, I worked on projects for television shows (Discovery and PBS) and museums around the world.

Self-directed and ambitious, it seemed this creative and entrepreneurial path could be my way to make movies in a realm I could access and control. And I did. During and after high school became a season of making short movies both fully animated and live action with animation. It was exciting and fun (but to my dad’s point above, most of these projects were never finished).

With knowledge and developing skills in computers and animation, I believed this would be my easiest path through college while also satisfying the expectations of finishing. But, a degree does not equal success. It’s simply a memorial for the success lived out daily to get there (John Maxwell).

For the most part, I was able to skirt through college at the Art Institute of Atlanta and get my degree riding on my past skill sets, experiences (3d animation intern and short filmmaker), charm, adaptability, and problem-solving abilities.

But, while I thought I could get through without an issue, two classes crushed me, and I could not get around them.

Advanced figure drawing and advanced character design were too hard for me, and I failed them both (C grades are required to pass classes in college). With practice and dedication, I could have passed, but I was chasing too many visions outside of school and was simply wanting to coast along to my graduation. I didn’t give the school time required to elevate my skills and pass the classes, and my natural talent for these courses wasn’t enough.

I retook them both and passed by the skin of my teeth. For the character design class, I found an easier teacher and also one that motivated and helped me in the ways I needed. The advanced drawing class was retaken with the same teacher, but having an extra semester of practice gave me enough improvement to pass. But, the retake of this course was in my last semester so if I failed, I wouldn’t graduate. I left myself no margin.

Since 2008 when I graduated, I’ve been haunted by nightmares of people from the school visiting me to let me know I didn’t actually graduate and my degree would be rescinded until I passed this advanced drawing class. The terror of going back to school was the content of my nightmares, and it revolved around the idea of being found out. Caught for not doing what I ought to be doing. The haunting of going back to resolve something I hadn’t yet finished but thought (and hoped) I had. And while I passed both classes and graduated, I know myself and my intentions.

At the end of the day, the school got their money and did the best they could, but I robbed myself from what my education could have been. While I did learn insights, developed skills, and fostered good relationships, the best value I received from my college education (and paying off the subsequent loan) is how it slowed me down. It was a giant speed bump for my life. This was good for me but also unwanted.

What I desired at the front end was the quickest easiest path to my destination, but instead, I extended the journey multiple times longer than it could have been had I not sought out a shortcut.

Where I expected to be in life today as a thirty-four-year-old is nowhere near where I wanted and expected. And, some of my aspirations and goals are actually still far off in the distance.

But, I’m now content with the timeline, and the necessary hard work required to move towards the desired end game, even if that end game never comes to pass.

There are no shortcuts. Pursuing what we perceive to be faster routes tend to delay the entire process.

Since I was going to attend college, I should have gone fully committed to the journey and learning. Otherwise, I should have said no and pursued the alternative path, even if it was against my parent’s wishes.

Photo by Simon Fitall on Unsplash

The Reality (Cost) Of College Borrowing

Short Answer:

Over ten years, we paid ~$59k in interest to borrow ~$96k for Cait and my college education. Our required payments would be 25% of our monthly take-home income after college. Yeah, these real numbers were a shock to me too.

Long Answer:

When it comes to helping upcoming students decide on how they want to proceed with college, and borrowing to go through it, there are three powerful and sobering numbers to help them make the decision on how to proceed.

Schools should share these with students as part of the recruiting process (Some innovative colleges are exploring taking ownership of these results with their students).

-

The amount of interest (including accrued interest while attending) the student will likely pay on both their spouse's and their loans for the amount they are borrowing (We paid $59k to borrow $96k over ten years).

-

How much their average take-home pay (after taxes) will be upon graduating college with their degree.

-

What percentage of their income will be allocated towards student loans? And how that will affect other aspirations like home ownership, saving, and long-term investing.

These numbers and projections are a quick and high-quality reality check on what’s to come on the other side of graduating with extensive debt.

For us, we paid $58,778.45 of interest (~$13k of capitalized interest accrued while attending school and during our one-year payment break) to borrow $95,993.38 for our college education. And, we paid it off in ten years with an average interest rate of 4.5%. The total interest paid back would have been much higher with a thirty-year repayment plan.

Let me say it again. We paid ~$59k to borrow ~$96k. Let that sink in.

If I knew that ahead of time, I would have reconsidered. Well, maybe.

If we had prepaid for college, it still would have been high, but we would have at least started our careers at zero instead of negative ~$155k.

Our minimum student loan payments for both of us was $1,100/month on a fifteen-year repayment track (it went up as we accelerated repayment during the final year). This was over a quarter of our monthly income for a majority of the decade, just to repay our students loans.

It seems appropriate for schools recruiting students to run their prospects through these realities before they jump into the deep end. They could say something like the following.

"Here is how much interest you will pay to borrow the amount you need for school. And, based on the average amount your degree takes home each month after graduation, this will be the amount you pay each month for the next fifteen or thirty years. And, that's if you use your degree."

Now, there are some exceptions where this educational reality may still be worth moving forward with college debt.

With a strong plan in place, and going to college for a degree that realistically warrants the salary to quickly repay the loan, there are situations where borrowing makes sense as an investment in future income earning potential. But for most students where this does make sense, they don't have a focused plan in place before they begin. And for the majority of students, the amount borrowed does not match how much will be earned after graduation.

Students, be realistic. Parents, be clear with your kids about the cost. And schools, be honest about how this unfolds.

Photo by Vlad Bagacian on Unsplash

The Journey To Pay Off Our Student Loans

Short Answer:

Paying off our student loans was an accelerated but indirect and windy path. We could have paid it off earlier, but due to competing agendas, we took an extended route (even within the fairly quick ten years). Now that it's paid off, I'm grateful for many of the detours we took, and how they'll affect our lives for years to come. Ironically, it would be my original entrepreneurial path (not a college education) that would make it all possible.

Long Answer:

I graduated from college in 2008. Within a year, I began making loan payments. A year later, my wife’s loan was added into our payment schedule following her graduation. And this began what would end up being a ten-year journey to pay off our loans.

Our collective payments were $1,100/month. But, for the first several years of these payments, it was my wife who was diligent about making sure we were diligently paying, and those occasional extra payments were made along the way. While I earned the income and was busy focused on the business, she helped direct that money in a fruitful way that we would both later benefit from.

It was also during this time (which took about two years) where we paid back thirty-thousand dollars of accrued business debt from poor decisions and some foolishness.

In early 2013, we decided to seriously ramp up our efforts to pay off the loan by mapping out the remaining payment pathway, selling off much of our stuff, and downsizing our life. Our plan had us paying off the loans a few years ago.

What we didn’t expect in 2013 was that additional income would instead be needed to help us live through the unexpected company-wide Sabbath year (a year of rest and release). As a result of our decreased income, we paused our loan payments for a year while we went through the roller coaster (wonder and terror) of this experience (which also played an important role in learning to finish well).

After shutting down the business and launching into freelancing in 2014, we continued the process of paying on our loans. And it was this vocational path (through the grace of God and His extended provision) that equipped us to finish the job and do it more rapidly. Ironically, it was entrepreneurship that paved the way to get out from behind and make large strides to get ahead.

Now, while we paid off our student loan in July 2019, we actually could have paid it off a few years earlier. If it had been up to me, I would have. But, I would have also missed out on essential aspects of what is our life today (our home, neighborhood, and community church). Through the give and take wrestling between my wife and me, we were able to both finish our loan while also accomplishing several other big milestones along the way.

Yep, we decided to carry an even larger burden, haha. Here’s how that unfolded.

During the initial freelancing years, my intent was to build a strong financial position and lay the groundwork for us to live and give generously. This involved buying a house, something Cait always wanted but that we could never make work due to the ups and downs of our marketing business journey.

So in 2016, when I desired to pay off the student loans, Cait wanted to instead buy a home. This would be a large pivot to our repayment plan.

Instead of saying no, I expressed how we could proceed as long as we followed several specific financial, relational, and discipline guidelines. These guidelines would allow us to save for the house down payment while also building financial disciplines for us to live more responsibly and prosperously. And, it would strengthen our marriage and our shared relational vision.

We proceeded with this plan, saved the house payment and an additional emergency fund, to finally equip us to buy our first home in early 2017. This is money that could have almost wiped out our student loans.

A few months after moving in, the transmission in our minivan died. We decided to buy a slightly used replacement (with a loan) instead of repairing the vehicle. But, like the house, I was only willing to proceed if we would commit to a stricter budget and plan to pay it off in a year. Like the house, it would foster additional financial disciplines to help us live responsibly and prosperously. It would also further unify my wife and me.

When I think about these two scenarios, it reminds me of the Apollo 13 mission to the moon. After facing catastrophic failures on the trip, they’re forced to problem solve on how to get back home. To get back to earth required they go further away towards the moon, but the ship would use the moon's gravity to propel it back to earth (something the ship couldn’t have otherwise done on its own).

In several ways, our plan and actions required to buy a house and pay off our minivan facilitated the gravity needed to propel us to, and more importantly beyond, the finish line.

Once the van was paid off, we increased our student loan payments to $2,600/month, drastically accelerating the last leg of the repayment journey. We also had a few good breaks along the way (tax refunds, a small gift from my parents, and other unexpected income) to help us along.

But, we also had a few smaller detours that would unfold. And this doesn’t include many smaller lifestyle choices we were unwilling to sacrifice along the way (which could have accelerated it further).

While the loan could have been paid off a few months earlier, we decided to send my wife back to San Diego to visit her sick Grandmother, we upgraded our washing machines, and we went over budget for several months in a row. And in May, I wanted to better equip my wife on her new ventures by purchasing her a much better and usable laptop.

These smaller things extended the pay-off a few months, but these choices were worth the sacrifice.

And now these student loans are paid off.

While the journey to success was extended further than expected or desired, we’re now in a wonderful home, with an amazing community, and we’ve got a paid off 2017 minivan that will last is another decade.

It wasn’t quite the straight line we had hoped, and I would love to have knocked it out much sooner, but I’m grateful that it’s finally done and for the many beautiful benefits that we’ve received along the way as part of our commitment to the process.

And it was the repayment of that pesky student loan that finally memorialized me conquering the very deficiency my father saw in me from the get-go (not finishing what I started).

With a student loan, there is no way out (not even bankruptcy). I know someone who has shirked responsibility on paying back their student loans. He doesn't make payments and simply throws away the bills when they arrive each month. This is no way to live, and it will cause problems for this person as his life advances. The emotional weight of carrying this bulls-eye around with the real-world consequences is a giant prison one cannot easily escape.

But, I suspect all of us considered this approach of ignoring student loans, even if we didn't act on it. What if we could just shirk responsibility? Or, what if someone swooped in and rescued us from the responsibility of paying it back?

There are no shortcuts.

My encouragement is to accept responsibility for these loans, embrace the grind, accelerate the process where you can, leverage it as an opportunity to grow yourself and relationships, and move forward with your life.

With our kids, we can apply these lessons to help prevent them from going down the same foolish paths we did, and more effectively help them navigate it wisely.

How I'd Do College Differently Now

Short Answer:

I’d attend college at a level and pace that would allow us to prepay for it as we went. Unless there is a specific plan with realistic expectations on resolving debt post-graduation, don't borrow.

Long Answer:

If I were to go back in time and attend college, how would I go about it differently?

My issue is not with how I started the process, but more about how I got off track with the initial plan, and how I was blinded by dreams, aspirations, and love.

My first year of college was at Northern Arizona University and was primarily funded by a Pell grant due to my parent's income level. Unfortunately the following year their income increased, and I was no longer eligible for it. So, instead of borrowing money to attend the university, I transferred to an affordable local community college. A year behind, Cait's first year of college during my second year was funded by her father (who like my dad, also had not graduated college).

Principally, this is how I would have continued the process. Attend an inexpensive school as long as I could, and transfer to another school to get the degree I was seeking. However this would have played out, I would have funded school along the way, and saved up during the summers. No debt, and prepay for everything.

Starting off, we were both making wise decisions, with a bright future ahead of us. But, things took a turn towards the foolish.

During my time at the community college, Cait and I got engaged. As part of our future planning, we decided we'd move to a larger city to pursue our ambitions, and finish college. While we considered California or New York, we realized it was going to be way too expensive and hard to make it work. So, we opted for Atlanta, a large city with great potential (and that was before the film market really took off).

While Cait's father was willing to pay for her college as a single woman, he was unwilling to do so when she got married. Us getting married meant we were now paying for all of her college fees. This expected generosity now became a burden.

And for me, I got a bit lost in the dream world, losing sight of the consequences of my numerous decisions (getting married, moving across the country, going to college, etc...).

I let loose with responsibility and decided to attend an expensive school, the Art Institute of Atlanta, completely on student loans. I was a bit in denial about reality while also living in the future dream world to come. We'd have a business, and be making major movies. Any fees we incurred would easily be paid for by our exciting and highly successful ventures (or so I hoped).

My parents were unable to help pay for college, so anything I did was coming out of my own pocket. My mom co-signed the loans, and we left Arizona to pursue our dreams. Everything and everyone we knew was in the rear view mirror as we moved across the county to the east coast. It was exciting until it wasn't. We both attended The Art Institute of Atlanta after we moved, but Cait (smarter then me) transferred to another online school (but still expensive) to get a different degree more in line with her interests (child counseling).

I got a degree that would make college easy, and Cait got a degree because she thought it was expected from both her father and me. Both of our parents wanted us to go to college, but neither were actually paying for it. In retrospect, it feels a bit like we were filling their aspirations through us, instead of the aspirations for ourselves (another lesson to explore at another time). Ultimately, we know they wanted the best for us and our future.

Unfortunately, I probably should have gotten a degree in business or writing (to practically help what followed vocationally). Or, I should have gone to school for directing movies (what I ultimately want to do). But, I chose the easiest path instead of the right one.

Because I accelerated the post-high-school education process and was enabled to do so because of the loans, I wasn't able to allow the college experience to organically unfold. The extension of prepaying and earning for college would have given me time and tension to figure out my path. And if it didn't, we would have at least gone into the next stage with a stronger financial foundation (instead of in debt).

Also, Cait and I never had the conversation that would have prevented some of our financial headaches. It turns out, Cait wanted to be a stay at home mom and was only going to college because she felt obligated to do so. Since we never discussed it, and I never gave her permission to be a stay at home mom (skipping college), she went to college anyway. Yeah, this conversation was the one we had after she graduated, instead of before it (it was an expensive one).

While we look at our current situation, we don't know yet know how things might unfold and how these degrees may actually play a role in our future, so there's still a possibility of a redemptive application of our choices. That's our hope.

But, when it comes to others, and our children, we've now got real-world experience and lessons learned to help others navigate the same challenges, and blind spots we stumbled through on our own. And, merging of debt and stumbling does not lead to fruitful outcomes.

Photo by Nathan Dumlao on Unsplash

My Thoughts On Student Loan Forgiveness, Free College, And Aiding Our Kid’s College

Short Answer:

While there may be situations where loan forgiveness is appropriate, providing it for the majority of students robs them of the opportunity to accept responsibility, and grow as people for the decisions they've made. And, there are numerous affordable post-high-school options for those who decide higher education is the most appropriate next step (in addition to numerous available funds to help). Lastly, if we were equipped to aid our kids financially with college, it'd be done in a way that transitions/incentivizes their responsibility of it as it progresses.

Long Answer:

"Peter Pan didn't want to grow up, and he counted on Wendy Darling to take care of him. Today, many Wendys willingly choose to care for the Peter Pan adult males in their lives, but their initial desire to nurture soon devolves into enabling or codependency." - Keith Eigel, PhD. - The Map

Would you reject a generous offer to pay off your student loan?

A few years back, I discussed with my dad about the idea of someone unexpectedly offering to pay off our student loans. I clearly stated how if someone wanted to help me, I wouldn’t want them to take away the achievement opportunity by entirely paying off the student loan for us. I’d rather we completed the task through our own efforts (help in small ways along the way is fine). If someone were to act in such a generous way, I’d prefer it was a gift given after completing the journey, not during it.

That’s a flipped script from how I (and probably most others) would have answered it at the front end of the loan paying process. A change in me arose out of the last decade from my faith, marriage, community, and vocational journeys. It feels good to see a challenge and overcome it. While support and help along the way are invited (we can’t do it alone), having someone entirely do something for us that we should do for ourselves (when we’re capable, even when it stretches us) seems problematic. Life is hard, so we all should work towards owning our part of it to make it better as we go through it together. And through the process, we become better leaders.

On the horizon, I see an important milestone with the generation of millennials who have these student loans as the result of our collective borrowing decisions (often made haphazardly). Ahead of us is a transformative and empowering character developing process unfolding as we take responsibility and pay off our collective student loan debt. And through this process, will arise the transformation of a group of powerful contributors to our future families and communities.

It very well could be this obstacle that accelerates the maturity journey for a majority and equips us to more effectively deal with an ever-increasing complex world.

"Many parents protect their children from the consequences of their choices. They prevent them from experiencing the challenges and contradictions that force them to grow. These parents may mean well and love their children, but they risk robbing their kids of opportunities to grow and mature." - Karl Kuhnert, PhD. The Map

When I think about mass loan forgiveness, both of these quotes from Keith (the Peter Pan one) and Karl's (above) come to mind. It's more complex than I can clearly articulate or attempt to solve in a few paragraphs, but this message seems to paint a vital aspect of the picture we may not consider as we seek to help each other overcome what feels and looks like an insurmountable obstacle individually and collectively.

It's powerful, and personally transformational when we actually solve our own problems. The strengthening process of freeing oneself from the burden of student loans is an important ingredient for standing strong and becoming the thriving leader that can succeed at our goals and generously contribute positively to the world around us.

My concern is that by passing sweeping mass loan forgiveness, we'll perpetuate the underlying problems, in addition to stunting the growth of our generation (not to mention the numerous problems that come with how this is funded). And it seems the journey we go through to pay off our loans and remove this burden may very well inspire and inform the ideas we need to systematically solve the root problems with higher education (and its associated costs).

But, maybe there are other solutions out there that resolve my reservations, accomplish the greater goal, while also helping former students effectively tackle this financial problem.

Affordable College & Some Ideas On How We Educate The World (For Free)

What does it look like to support my kids through their college education? And how do we solve the problem of making college training more affordable? I don't have the answers to these questions, but there are a few ideas bouncing around in my head to help get us started.

When it comes to supporting children with paying their education, I'm inclined to support them in a way that gives them a leg up, equips them to slowly take responsibility for their burden, and is an appropriate amount of help to the financial capacity we have as parents.

Assuming we had the available funds to do so, one idea is to pay a larger amount of their college up front and lessen the percentage we provide along the way. Year one, we'd pay 75% of their tuition. Year two would be split with year three involving us pay 25%. The final year would require our children to pay 100% of their tuition.

I'd also heavily support them in ways that would help them start and continue the income creation through entrepreneurial efforts (or exclusively through this method if they chose not to go to school).

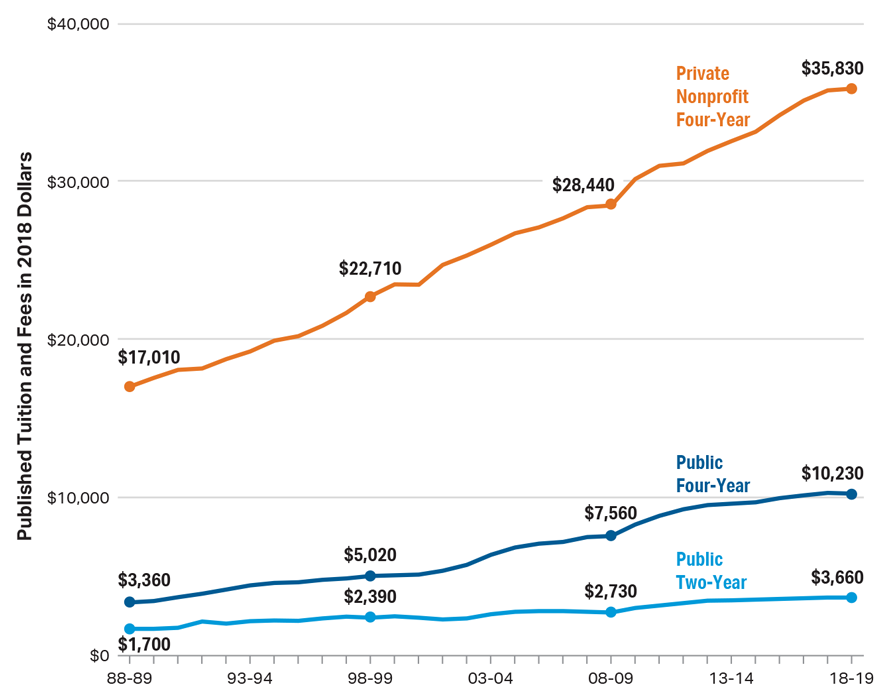

There's more to consider as part of this idea, but I'll have a multitude of years to craft a system before my kids get close to attending college. Which, according to this graph on the cost of tuition over time, could be sky high (for private college). Maybe the public schooling route is a perfectly reasonable option for most people.

When it comes to providing an affordable college education, it seems the answers are out there and can be found with some great examples, like the Kahn Academy. As well as the many affordable colleges that do currently exist around the country. Plus, anyone could simply work for McDonald's and earn up to ten thousand dollars towards their tuition (as one of the numerous options available to help fund school).

A critical question to help us get to the solution of affordable college at scale is, "how do we college educate the world for free?"

Our solution is not intended to create a free option (although it may be possible). It's instead designed to simulate the limitation that would lead to profound and effective ideas for solving the higher education problem not just for our country, but for people around the globe.

As an example of how we could accomplish this, let me share one idea that comes to mind from this question.

There are five-thousand colleges in America. I suspect there are a few thousand classes of English 101 being taught. That’s rather redundant to have so many teachers teaching the same thing. Let's get the five best teachers across the nation to record the program and place it online for people to access. Now, the teachers can focus on helping local students along, and others can specialize in different topics. Schools can focus on other ways to provide value other than simply educating on the fundamentals. This is a simple way of looking at this problem, but it's a thought-provoking way to explore solutions.

Or, what if students in a higher grade were tasked with teaching the lower grade as part of their learning agenda (because we also learn when we teach)? We essentially would create an ongoing layered teaching system that is, at the highest level, guided by teachers, professors, and PhDs, but also has a shared responsibility of teaching across the grade levels by the students.

Or, what if colleges used the dividends of their endowments to pay for students to go through their programs (instead of continually expanding their programs)? With billions of dollars and the associated dividends, it seems we could create a prosperous system for bolstering up students instead of doing so exclusively for these institutions (even if it means their expansion is slowed).

I don't have the answers or know the best path forward, but it seems to me there are numerous marketplace options that would allow us to solve these big problems in innovative ways.

With the right questions, smart people, and a shared vision, we could get ourselves to a powerful place of thriving together in the higher education arena.

Wrapping It Up

Paying off our student loan feels like being disciplined by a parent or a boss. It's an unwanted and unpleasant process, but it changes us (hopefully for the better). As you go through it (or you watch others do so), think of it a great challenge to overcome. And with many little steps along the way, you can.

My encouragement to future students is to fully understand what it means to borrow large sums of money, and how you'll leverage your post-high-school education for intentional forward movement in your life. Be cautious in how and how much you borrow to make this happen.

If you're stuck in the middle of the repayment process, make a plan to downsize your life, maximize your income and go after the student loans as hard and fast as you're can. Embrace the challenge and reflect along the way. Learn how you can better help your kids and the next generations while also coming up with creative ways to solve these problems (while also allowing them to take responsibility).

While ten years may seem like a long time, it's a lot quicker than you think. And, it's a lot shorter than twenty or thirty years. Who wants to be paying off their student loans well into their fifties?

We did it. And you can pay your student loans off too!

Go make it happen!

Additional Resources

- Read Cait's Perspective on paying off our student loans.

- Explore my full commentary of The Map by Keith Eigel and Karl Kuhnert, the book quoted above.

-

Freakonomics Podcast: The $1.5 Trillion Question: How to Fix Student-Loan Debt? (Ep. 377)

-

Wall Street Journal Article: Student Loans Change Lives. Ignoring college debt is a luxury that many cannot afford.

-

Yahoo! Finance Article: Nearly 25% of Gen X believes it’s ‘nearly impossible’ to pay off debt: survey

-

Seth Godin: On Finishing Well

-

The New York Times: Morehouse College Graduates’ Student Loans to Be Paid Off by Billionaire

- The Wall Street Journal: Buried in Student Debt? Here’s How to Play Catch-Up.

- SFGate: Warren proposes student debt forgiveness, free tuition plan

-

Business Insider: People are fleeing the US to keep from paying off their student loans

- Wall Street Journal:The Long Road To The Student Debt Crisis