Beyond Tithing: How Your Investments Can Build God's Kingdom With Dana & Bill Wichterman

Ever feel like your money controls you, not the other way around? You're not alone. Many of us are caught in the cycle of earning, spending, and saving without a clear purpose. But what if there's a different way to think about wealth?

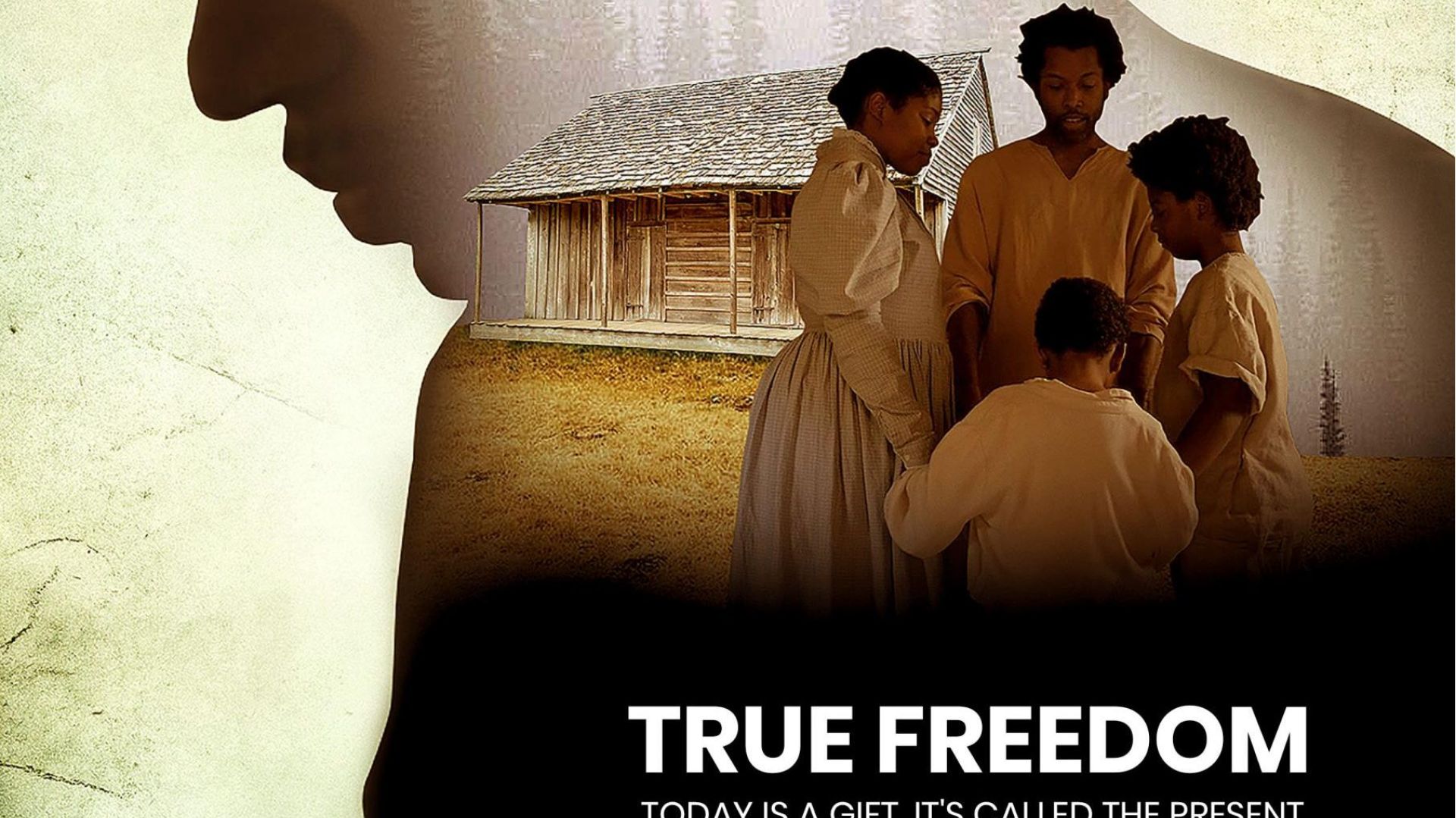

Dana and Bill Wichterman have a radical idea: shift from owning to stewarding. In this Listen-To-Learn episode of the Share Life podcast, they reveal how viewing wealth as a gift, not a possession, can transform your life. They challenge the myth that more money equals more control. Instead, they argue that true freedom comes from surrendering your resources to a higher purpose.

Intrigued? Here are a few surprising insights from their talk:

- The Illusion of Control: Discover why even billionaires can't escape this trap.

- Generosity as an Antidote: Learn how giving can actually cure loneliness.

- The Power of Stewardship: Find out why aligning your investments with your values is more impactful than you think.

But here's the catch... Are you making the fatal mistake of hoarding wealth, thinking it will keep you safe?

Watch the video NOW to uncover the full truth and start your journey towards financial freedom.

P.S. If you're silently struggling with the pressure of financial decisions, you're not alone.

- Watch: Click here to watch this discussion on YouTube directly, or click play on the embedded video above to begin streaming the interview. Click here to subscribe to my YouTube channel.

- Listen: Click here to listen on Spotify directly, or click play below to begin streaming immediately. You can also find this discussion on Pocket Casts, iTunes, Spotify, and wherever you listen to podcasts under the name Share Life: Systems and Stories to Live Better & Work Smarter or Jason Scott Montoya.

Connect With the Wichtermans

- Connect with Dana & Bill Wichterman >>> Website - Instagram - YouTube - Linkedin - Facebook - X

- Get the book: Stewards Not Owners Book on Amazon

Additional Resources

- The Purpose Driven Life by Rick Warren: Mentioned in reference to Rick Warren's story of giving away the profits from this highly successful book.

- The Freedom of Self-Forgetfulness by Timothy Keller: Bill references this book when discussing the concept of humility and thinking about yourself less.

- Larry Burkett's Books: Dana mentions going through materials from Larry Burkett, a founder of Crown Financial Ministries, early in her marriage.

- Crown Financial Ministries: Mentioned as a source of free, foundational materials on biblical financial principles.

- Kingdom Advisors: Bill mentions this network of certified financial advisors who help clients align their money with their faith.

- faithdriveninvestor.org: Recommended by Dana as a starting point for aligning investments with faith, offering free resources, podcasts, and small groups.

- Impact Foundation: Dana's organization, which functions as a donor-advised fund allowing for charitable impact investing in for-profit companies.

- National Christian Foundation: Mentioned as a large donor-advised fund for those who want to give primarily to non-profit organizations.

- faithdrivenentrepreneur.org: Suggested as a resource to find and learn about faith-driven companies and entrepreneurs, including those overseas.

- Sunshine Nut: The name of the cashew company in Mozambique, founded by Don and Tarryn Larson, that was visited by the Wichterman family.

-

Rick Warren's TED Talk: Jason references a TED Talk where Rick Warren discusses his decision to give away the money he earned from The Purpose Driven Life. The specific talk is titled "A life of purpose," from the TED2006 conference.

Podcast Episode Transcript

Dana Wichterman (00:00) I'm looking at the investment where every investment does have an impact. It promotes a good company or a bad company—a company that's doing something good in the world or destructive. As an investor, you have the power to direct your investments towards those companies that are creating goods and services in the world that are doing something good. That is why Bill and I wrote the book. Bill Wichterman (00:23) How about if you worked one more year and you resolved to give away everything you made that year after you paid your taxes? See what that's like, and then try doing that a second and a third year. See what it's like and see if you don't find the incredible joy of writing those big checks. Jason Montoya (01:19) Welcome to a Listen to Learn episode of the Share Life podcast. I'm Jason Scott Montoya, and today I'm speaking with the authors of the book, Stewards Not Owners: The Joy of Aligning Your Money with Your Faith. Dana and Bill, say hello. Dana Wichterman (01:32) Hello. Bill Wichterman (01:32) Hey, good to be with you. Jason Montoya (01:34) Yes, thank you for joining and sharing your stewardship wisdom with us today. Dana is a senior advisor at Impact Foundation and founded the Faith Driven Entrepreneur and Investor Network in Washington, D.C. Bill, a former White House special assistant, co-founded Wedgwood Circle and leads Faith Law as board president. Their book, Stewards Not Owners, inspires a perspective shift from owning to stewarding, viewing wealth, work, and resources as God's gifts to be used with purpose. It provides insights on values-based investing, generosity, thoughtful budgeting, and more. In this conversation, we're going to focus on two ideas within the book: giving versus investing and stewardship versus ownership. Before we dive into my questions, Dana and Bill, tell me a bit about your background and what led you both to write this book. Dana Wichterman (02:21) Sure, I'll start. Even as a little girl, I felt I was put on this earth to make it better, like leaving a campsite better than you found it. I feel all of us have a purpose. Jason Montoya (02:34) Mm. Dana Wichterman (02:50) Looking for that impact, or calling, has been a lifelong quest. Stewarding our resources and money is a practical way to have a more effective impact in the areas we're supposed to. We're each here, equipped to help fix something that's broken or make something ugly more beautiful in this world. That's been my lifelong quest. I worked in government and the nonprofit sector, looking at them as levers for change. But now, I'm looking at the investment space where every investment has an impact. It promotes a good or a bad company, one doing something good or destructive. As an investor, you have the power to direct your investments towards companies creating good in the world. That is why Bill and I wrote the book; we've had a long life of trying to think through how to have a positive impact. We wanted to, first of all, tell stories of other people who are doing it well. The book has 24 stories of amazing people living a life surrendered to stewardship, and we also bring in the practical tools. Jason Montoya (04:23) You have these different levers you've mentioned. Dive into that a little bit more. Dana Wichterman (04:26) Yeah. So when we think of being change-makers or having a positive impact, think of what interventions, skills, and tools we would need. Obviously, almost every intervention requires some amount of finances, right? Starting a nonprofit or your podcast requires some finances. It also requires skills, relationships, and ideas. So there are different levels of investment. That is what we're talking about. Bill, do you have anything to add? Bill Wichterman (05:06) No, I think that actually captures it. Jason Montoya (05:08) Well, Bill, what would you say to someone who's like, what is a stewardship mindset? What is stewardship, not ownership? How do you think about that? What's the origin and source of where that comes from? Bill Wichterman (05:20) Yeah, it really comes from this notion—I think it's fundamentally a theological notion—that you're given your life. I would argue our lives are principally responsibilities given to us to steward, rather than gifts to do whatever we want with. That notion of, "Well, you just go and do what you want now, it's yours"—I think with God, there are always strings attached. Jason Montoya (05:49) Yeah. Bill Wichterman (05:49) It says in the Old Testament that God is a jealous God. I remember as a kid thinking, "Jealous? Well, we're not supposed to be jealous, so why would God be jealous?" What that really means is God hates idolatry and he will brook no rivals. He wants us completely for himself. He's not looking for a religion that's a box-checking thing where God gets his portion and I get my portion. He's not interested in that. He wants to own all of us, including even those parts where we might otherwise linger. Jason Montoya (06:20) Yeah. Bill Wichterman (06:20) You think about the story of the rich young man in scripture where he said, "What do I have to do, Jesus, to get eternal life?" And Jesus said, "Follow the commands," and listed a few of them. He brightens up and is like, "That's great. I've done all those since I was a kid." And Jesus said, "One thing you lack. Sell everything you have, give it to the poor, and come and follow me." And he went away sad because he had great wealth, is what scripture says. Now, does God call most of us to give away everything? No. We think you're supposed to surrender everything to God. For most of us, that doesn't mean the same as giving it all away. Surrendering means letting it be under his control. You saw a guy who had most of his life under the Lordship of Christ, but there was just one part that he wanted to own all by himself. And I think that's out of bounds for what it means to be a follower of Christ. Jason Montoya (07:33) Yeah. Bill Wichterman (07:33) Jesus said, "If anyone would come after me, he must deny himself, take up his cross daily and follow me. Whoever wants to save his life will lose it, and whoever loses his life for me will save it." I think that notion of looking at everything we have, including our money, which is often a stronghold for people, is liberating. A lot of people recoil at this notion; they're afraid of it. And that's why we put in the subtitle of our book, The Joy of Aligning Your Money with Faith, because what we found in the 24 stories of people we interviewed was the incredible joy that people had in surrendering all of their resources to God, including all of their money. Jason Montoya (08:06) Yeah. So you mentioned the fear. Dive into that. What are the fears that people have about that surrender? Dana Wichterman (08:14) Well, when you first hear that word, you feel like you're losing control. You've worked so hard. For me, it was a lack of trust. It revealed, "Wait, if God is really a good God, then he wouldn't have me steward the resources he's given me in any way other than what would be good." So I think some of it is a learning process. He also gives us a lot of grace to stumble, fail, and try again, so people don't have to be perfect at this. You start small, with little bits of giving, and see what kind of joy comes from that. I would argue sometimes it doesn't come right away; it comes later after you see the impact or the fruits. I would say it's exercising certain virtue muscles. Generosity is something you need to walk into and think creatively about. I mean, even your platform is a generous platform for thinking and inviting people into thoughts. I think we need to be curious people and try to address generosity in every aspect of our life, including our time, our home, and hospitality. Jason Montoya (09:39) Yeah. So how do you think about just money, generally speaking, as an idea and how it applies to stewardship specifically? Bill Wichterman (09:49) Well, money is one of the things we steward. We also steward our time, our talents, our ties, and our relationships, but money is one important way. And that's what we focused on in the book. We thought about doing a more comprehensive stewardship book, but we had so much to say just about the stewardship of money that we thought, "No, that's good enough for this book." Jason Montoya (10:09) Ha. Bill Wichterman (10:19) I think it is a stronghold. There's a reason it's called mammon; it's given a demonic name in scripture because, for many people, it's very hard to give up the notion of control over your money. As Dana said, there's all that fear about what that could mean. And look, following God can be a fearful thing. That's been my life when he asked me to give up something that I don't want to give up. That's hard. And if you just want to be on the throne of your own heart, then you may as well stop kidding yourself that you're a Christian because to be a follower of Christ means you've got to surrender. We think in the money space, it's a blind spot for a lot of people. A lot of people come to it saying, "God gets his cut, kind of like the taxman. You pay your taxes, and the rest of the money is yours. I pay my tithe, and the rest is ours." I don't think that's the way it works. Jason Montoya (11:41) Yeah. Bill Wichterman (11:42) I think a tithe is there as a way of supporting the church in particular, but it's a floor, not a ceiling. It doesn't mean that the other 90% is yours to do whatever you want with. It goes all the way down to your spending, your saving, your investing. Every bit of it is to be under the Lordship of Christ. Jason Montoya (11:50) Now, talk to me about this idea of how stewardship and sustainably doing it relate. You mentioned generosity earlier, Dana, but also the idea of charity and how that relates. Kind of tease out these different layers for us. Dana Wichterman (12:12) Sure. So when we talk about savings, which you would then use for either investing or for charity, you first have to generate excess capacity from your own needs, which would be through wise savings over time. And then once you have savings, you're giving to charity. I think you look at the areas that God's called you, the impact he wants you to have, including your local church, maybe your neighbors, and other things like that. Then you're investing, which investing again is supposed to make money. That's fine. That's what businesses do. But again, we want to make sure that our investments are also having multiple bottom lines: making money, but also doing good in the world. There are a lot of financial advisors now that help you screen out bad investments and screen in good investments. But when you talk about impact, I think that we in the West use the lens of non-profits are supposed to solve all problems. And it means give money to a non-profit and all their interventions are going to be helpful. And I think that's only true in certain interventions: disaster relief, something that's never going to charge someone, like going to church. You don't charge someone for going to church, so therefore you need a tithe. And there are a lot of disaster situations or crises or disability type things where they're going to need charity. And that's a fully appropriate intervention. But I think when we're talking about poverty alleviation over the long term, if you only give handouts rather than hand-ups, you're actually putting a band-aid on the problem and not getting at the core of the problem, which is that people need good, dignified jobs. Jason Montoya (14:16) Yeah. Dana Wichterman (14:16) And so to do that, you need to create businesses that are going to provide those jobs. And once you give someone a dignified, fair-wage, sustainable job, they will solve their own problems. They will be able to pay for their children's healthcare and for their children's education. So I think that's what we argue: looking at some longer-term strategies and which things are more effective for what problem you're solving. And I think too often charity, because it has to be continually funded by fundraising, is not creating the engine of growth, the market mechanism that will literally help countries lift most of their people out of poverty. Jason Montoya (15:06) Okay, so what would be an example of a sustainable engine that doesn't require that constant giving to make it go? Bill Wichterman (15:17) Like a business. Let me tell you about a particular one that we love. It's founded by a guy named John Porter, who's featured in our book. John was planning to be a missionary aid worker in Haiti, and he had this encounter with God in his car in a parking garage before an interview where, essentially, the Lord called him, "No, no, I want you to go into business." So he went into business, moved to Rwanda, and he started a creamery providing yogurt and other dairy products, which are much needed in the developing world. He currently has 60 people working for Masaka Farms, the name of this creamery. It is for-profit and employs a majority of people who are deaf, which in Rwanda, if you're deaf, you're not going to get a job and you're not going to be valued by society. You're going to be considered dead weight, worthless. Here they get dignifying jobs. They get a community of a lot of other deaf people. They can learn sign language that way. They can find marriage mates. But this is a for-profit business. It's dignified. That business every year is growing and growing. They're getting into new elements. Think of what it would cost to provide the money to support those 60 workers. You'd have to raise that money year after year. There's no money to be raised in this case. They're selling a product. And their kids will then grow up in a home where they have food security, where they have health security. When they get sick, they can call a doctor. And they can go to school. Those are huge things in any culture, but also in Africa. And they won't grow up with a poverty mindset. So that's the poverty prevention that Dana was talking about. The kids don't emerge from poverty because they weren't in poverty, and the parents got a job. So we just think that jobs are the best way to address many issues—not every issue, but in the poverty space, definitely. Jobs are far more efficacious than non-profits, in part because the non-profit pool of funding is so small relative to the investable assets that are available to generate jobs in the world. It's a problem of scale. A lot of people who've gone into business as mission realized that the problems were too big for non-profits. Jason Montoya (18:03) Yeah. And are there problems that are too big for businesses? Bill Wichterman (18:08) Yeah, there's problems that are too big for businesses. I mean, a business can't save your soul. That's a whole different rubric. But in general, it depends on what the problems are. But when you're talking economically, it's generally business that you're going to need. Now, you do need to have a macroeconomic system that makes sense. You need to have the rule of law and an absence of widespread corruption. There are a whole bunch of other things that are beyond the reach of a particular business person. So if you have an unjust government, which as soon as your business succeeds, they're going to come in and harvest it for their own use, well, that's a terrible thing and that's going to keep everybody poor. I used to live in West Berlin, Germany, and I used to go to the East side. That was when the Berlin Wall was up. Many of your listeners might not even remember that, Jason. It came down in 1989. But there was the communist side and the free side. And I would go to the end of my neighborhood, I would go through Checkpoint Charlie to get to the east side, the communist side. And immediately, I just saw poverty relative to what was on the west side. It was a bad economic system. Jason Montoya (19:25) And so what does stewardship look like if you're in that type of context? Dana Wichterman (19:32) Well, I think again, it's somewhat individual to what God has given you dominion over. So it might look like civil disobedience. It might look like encouraging good policies and trying to persuade the government to change. So again, government is a lever. You have to build roads. One individual business will not be building the interstate highway, right? So you have to pour yourself into good governance. And that's why we need good academics and good intellectuals to be percolating the right ideas of what is the good society. And then we need people to be the kind of informed citizens that will, at least in our case, vote in a way that will create these right enabling environments. Jason Montoya (20:29) Yeah. Now you mentioned the difference between a good outcome or a bad outcome, or a good nonprofit or a bad one. How are you defining what you consider good and bad in terms of investing into those organizations? Dana Wichterman (20:44) Okay, well, that's somewhat based on what people's priorities are for an outcome. I would say that most people would say that if a company is just polluting the groundwater around it, that that's a bad outcome. If they are working their employees to the bone and not compensating them, that might be a bad operating principle. If they are producing something that is creating addiction to pornography or whatever, again, a bad outcome. Now you can have all kinds of different values. Someone might be fine investing in the alcohol industry because if you can use it wisely, it can be a real joy. If you have addiction in your family, you may say, "No, I really don't want to promote that industry." So some things are personal and values-based, depending on that individual. But I think there are a lot of things that we all can agree on. I look at the UN Sustainable Development Goals that say what global problems we are trying to solve. And so those are one indicator to look at. And then who's doing it most efficiently, most effectively? And that'll have a different lens as well. Jason Montoya (21:40) Yeah. Yeah. And so where does the idea of redemptive investing play a part in all this? Bill Wichterman (22:11) So, Dana talked about negative screens and then positive screens in business. A negative screen is, like Dana was saying, "I don't want to invest in strip clubs," right? Alright, that's a negative screen. It doesn't matter if I get a good return on my dollar; I'm not going to do that. A positive screen is where you see a business which is well-run, which provides dignity and respect for the employees and provides a good product, which helps the world flourish. As Dana said, not everybody's going to look at that the same way, but if it lines up that way for you, it's a beautiful thing. When you get a business like that, you think, "Wow, this is really changing the world." There are some medical devices that we've invested in. One of them, if it comes to pass and can get FDA approval, will help older women who have UTIs, urinary tract infections, which is one of the leading reasons that older women go to the emergency room. It will take care of that. Well, that would be a beautiful thing, right? That helps the world flourish. We would love to see that. Jason Montoya (23:25) Yeah. And so how much of that type of a focus is that just a piece of the larger pie or is that one of the primary ways to look at investing? Dana Wichterman (23:39) That's a hard question. I think what we would like to encourage people is to say that all of their investments should be values-aligned. Now that doesn't mean all of them are invested in private companies that are doing good; there are some public ETFs and things that are also value-screened. But I think even just where you bank—when your money is sitting in a bank, that bank is using it to loan to other places. Well, kind of look at the values of your bank. So I would say you want to look at all your investments. Are they something that if the Lord said, "Open your books, I'd like to check out how your investments are doing," he'd be pleased with where you're putting your money—you're putting his money. Jason Montoya (24:26) Yeah, yeah. And part of that gets to the idea that no matter where that money's coming from or where you're placing it, you're back to what you said earlier about responsibility. You're responsible to God for the outcomes that your money and time and focus—the return you get from that, right? Is that what you're saying? Dana Wichterman (24:52) Yeah, and I'd also say we're responsible to our fellow human beings, you know, the whole concept of the common good. Jason Montoya (24:59) Mm. Yeah. Dana Wichterman (24:59) I think we've become such an individualistic country that we don't even think about what we have a responsibility for the commons, you know, and to make sure that those commons function well for everyone. And I am my brother's keeper in the sense that, to the extent that I can help them not be harmed and also flourish, I'd like to do that. Jason Montoya (25:24) Yeah. Dive more into that individualistic thinking, where it comes from and why it's so harmful. Bill Wichterman (25:31) So I think individualism is deep in the DNA of America, but it also is in another way deep in the DNA of the human heart. There's that sense that "I am my own master." And even though our culture and society is much more individualistic, I think even if you're in a more communal society, there's that sense that I can still make decisions that are going to be about me. And I think God wants the decisions to be about him. If you look at your life as itself something for you to steward, something which has been given to you, not just for your own pleasure, but as it says in the Westminster Confession, what is the chief end of man? To glorify God and enjoy him forever. That sense of enjoying Him and glorying in Him. 1 Corinthians 10:31 says, "So whether you eat or drink or whatever you do, do it all for the glory of God." Jason Montoya (26:43) Yeah. Bill Wichterman (26:43) In Colossians 3:23 it says, "Whatever you do, work at it with all your heart, as working for the Lord, not for human masters... it is the Lord Christ you are serving." So if you have that attitude about it, it's pretty hard to be individualistic at that point. Tim Keller wrote a little book I'm reading right now called The Freedom of Self-Forgetfulness. And he said being humble isn't thinking less of yourself, it's thinking about yourself less. Jason Montoya (27:10) Okay. Bill Wichterman (27:18) And if you have that attitude of a servant—because service is what we are all called to—it's transformative, and it includes our money. Jason Montoya (27:33) Yeah. Yeah. So would you say that the idea of autonomy, being hyper-individualistic, that worldview is in direct competition with a stewardship mindset then? Bill Wichterman (27:49) I think Dana and I are both strong individuals. We have a strong sense of self. But I think it has to be under the Lordship of Christ. I begin my day with my own liturgy that I made up, Jason. It goes like this: "You made me, you saved me, you own me, and you love me. There's nothing that I have that's not from you. There's nothing that's not a gift. I will choose to rejoice in today's hardships as an opportunity to become more like you, and I will not fear my future." All of that liturgy is really about God's ownership of me. That's the fundamental theme that runs through all those sentences. Jason Montoya (28:21) Yeah. Yeah. Now, if you're talking to someone that's not a Christian, is there an argument that you could make to them about stewardship or does that step require to make that leap? Dana Wichterman (28:47) No, I think you can talk about being values-aligned and having purpose and meaning. I think most people have the idea that they have a purpose that's outside of just fulfilling their own desires. Not everyone—most people are not hedonists, right? They understand that love of neighbor, love of creation is an important thing. And it's even been proven in secular studies. The recent flourishing study put out by Harvard and Baylor University, which looks at a whole bunch of indicators for flourishing, shows that there's a lot of things that are involved with serving other people. So I think you can make that argument to most people, that it's important to get outside of yourself. And then I think also people are discovering that being a lone island is lonely and that community is a beautiful thing. I don't know how you can have love unless you have community, because love takes two people at least. Jason Montoya (29:45) Yeah. Yeah. So what would you say—because the Surgeon General a few years ago said something like we are in a loneliness epidemic—what would you say about that as an encouragement to someone that might be listening that is maybe in that state and likes what you're saying, but doesn't know where to start? Dana Wichterman (30:19) Mmm. Bill Wichterman (30:20) I actually think generosity is a great antidote to loneliness. That's not the primary purpose; I'd say it's an ancillary benefit, though. Jason Montoya (30:25) Hmm. Yeah. Bill Wichterman (30:25) Because when you are being generous, you are seeing a need, entering into that person's need, and helping to solve that need. I think there are many people who spend a lot of time on the psychotherapy couch looking inside that would do so well to get out and think about serving others and finding other people's needs and how to address those. And it does connect you to people. Now, like all things, it can be twisted. So is it possible if you're being generous that you might get a savior complex and start expecting all the praise and adulation that comes with being a giver? Yeah, that's a bad thing. Jason Montoya (30:59) Yeah. Bill Wichterman (31:18) I think that's one of the reasons that Jesus said, on the one hand, "Don't let your right hand know what your left hand is doing when you're giving," in contradistinction to that guy who came with all the trumpets to put his gift into the treasury of the temple. But he also said, "Let your light shine and put it on a hill so that others might see it." Jason Montoya (31:39) Yeah. Bill Wichterman (31:39) So I think it's a heart disposition. If you're being generous outwardly, really just for self-aggrandizement, it's not going to work. There will be some benefits, but it's not the same as, "No, no, I really want to help you." If we could talk about retirement for a second, Jason, one of the things we write about in the book is challenging people to say when you could retire—you hit that place where you've got enough money saved up, you've got enough of a pension or whatever it is, and you could stop working and enjoy your golden years on the golf course, on the boat, doing whatever. Jason Montoya (31:59) Yeah, go ahead. Bill Wichterman (32:13) We say, how about if you worked one more year and you resolved to give away everything you made that year after you paid your taxes, and see what that's like? And then try doing that a second year and a third year. And see if you don't find the incredible joy of writing those big checks, right? A whole year's net wages that you get to give away and see how that transforms things. We've seen people for whom they don't want to stop working until they are told, "It's time for you to stop working," because they get incredible joy out of just giving and sharing with other people. Jason Montoya (33:05) Yeah, yeah, it reminds me of Rick Warren's TED Talk where he talks about how when The Purpose Driven Life became so successful and made so much money, he took all that money, he paid back the church everything it had ever paid him, and then he ended up doing reverse tithing where he gave 90% of his money away. Just an inspirational example of taking a step into that world that you're describing. Dana, do you have any thoughts on his story? Are you familiar with it? Dana Wichterman (33:36) I didn't know about the reverse tithe for him, but we've got some people in our book that have that kind of thing. There's a guy and his wife who started a cashew company in Mozambique. And their whole intention for that is to have world-class cashews that can be sold around the world—and they are sold on QVC and Whole Foods, et cetera. But the idea is that eventually, 90% of the profits will be helping smallholder farmers in Mozambique, and helping widows and orphans. So he's got that 90-10 switch as well, which I think is wonderful. Jason Montoya (34:16) Yeah, and that kind of gets to your idea of a business engine. If you have something that's continuing to provide value to make money, it really makes a difference. Bill Wichterman (34:32) Yeah, and this isn't just for the rich. No, if you're a teacher and you've put in your 25 years and you're nearing 60 and you get to retire and you've done the math with your financial advisor and you're like, "We can do this." You could just keep teaching, right? You don't have to stop. Just keep going and just give it away. Jason Montoya (34:38) Yeah. Yeah. Yeah. Well, and I think the other thing to think about is you can also think ahead, where you saved a certain number so that even after you stopped, you could just give away a lot. I guess I'm just trying to point out that there are different creative ways. Dana Wichterman (35:25) Well, actually I work for a place called Impact Foundation, which allows people to create their own mini endowments. It's a donor-advised fund. Jason Montoya (35:33) Okay. Yeah. Dana Wichterman (35:33) So you put your charitable capital in, it's in the charitable realm forever. You get your tax deduction, but it's in an account that is for you to direct, and you can invest it. You can also grant it and give it away to a nonprofit, but then you don't see it again. Or you can invest it in transformational companies that will have more than just a financial bottom line. But let's say they have a financial bottom line that comes back into your account. It's like the goose that lays the golden egg. You can have recyclable impact in a donor-advised fund. And if you manage that well, you can continue to do that. That functions like a foundation. Jason Montoya (36:16) Yeah. So I guess I'd be curious, if we really got serious with the financial wisdom in the way that you're describing, what kind of impact could that have? Bill Wichterman (36:31) Well, it would be transformative, Jason, because first of all, let's just start with the tithe. Imagine if all Christians tithed. Right now, American Christians give about 3%. So tithe means 10%, so they're not really tithing. Imagine if they actually gave 10%. My goodness, nonprofits would be awash in money. That would be more than three times what they've got right now. You'd have all kinds of well-funded ministries and charities. Now, what if you did what Dana is suggesting, that you actually start using some of that money that you put into a donor-advised fund and you start investing it in businesses. Wow, that's really transformative. You start providing jobs to people. It's the old adage about, "Give a man a fish, he'll eat for a day. Teach a man to fish, he'll eat for a lifetime." Then think about lining up all of your money, everything that you have control over. If you can control your IRA, your bank account, any stocks, any investments you have, and you start thinking, "I'm going to be faith-aligned with all of that money," now you're talking about a really big pot of money. Can you imagine if Christians started doing that very consciously? We knew of one Christian foundation where they paid somebody to do an analysis of their endowment to see where they were invested. And lo and behold, they were invested in a lot of things that they were trying to counter through their charitable giving. So it was like the right hand and the left hand working against one another. Jason Montoya (38:15) Yeah. Yeah. Bill Wichterman (38:15) I think that happens a lot. And when Dana first heard about this, she was kind of intimidated by the thought that we'd have to go through stock by stock, especially if you're in a mutual fund. But as Dana already mentioned, there are financial advisors that are called Kingdom Advisors. You can find them on the web. They've been certified to be a Kingdom Advisor and they will help you figure out, "Hey, how can I align my money with my faith?" This does not have to be an overwhelming project. The journey of a thousand miles starts with a single step. Just start somewhere. Jason Montoya (38:58) Yeah. Yeah, and I've seen a few ETFs out there that people could find to invest in that are exactly what you're talking about. Bill Wichterman (39:14) Totally. Yeah, Sovereign. Jason Montoya (39:17) Okay, yeah. So, I guess I'm curious, just your own story, is this something the two of you, when you first got married, were you already thinking this way? Or did this evolve over time? Dana Wichterman (39:35) Well, when we first got married—even before we got married, when we went through premarital counseling—they always talk about, "Is your financial philosophy aligned?" And that was the one we spent a lot of time on to make sure. We went through the Larry Burkett Crown Financial Ministries materials. Crown Financial Ministries still exists. They have wonderful, free materials. I would encourage people to go there. And that's where we learned the basics: save 10% or more, give 10% or more, and try to reduce your debt, particularly unproductive debt. And then, think through investing. The eighth wonder of the world is compound interest, and it goes both ways. If you get into debt, you compound in the wrong direction. Jason Montoya (40:28) Yeah. Yeah. Dana Wichterman (40:28) And if you are investing and paying off your debt, and then saving, it goes amazingly high up in the right direction. So teaching people that is important. We just dedicated ourselves. We were like, "If we're going to live in a closet-sized apartment for the first part of our life, we'll do it because we just don't want to be enslaved to debt." And then we did the tithing. Even though at the time it felt hard—it felt hard to me, I don't have the gift of giving, Bill has the gift of giving—so that felt more sacrificial. But then over time, you just make lifestyle choices that fit within that. Most people in America are some of the wealthiest in the world. We're not living in a shack in some country where we don't have running water. I think just learning those lifestyle habits and being committed to them was the portal that God used to sanctify me the most through life. He just kept showing layers of where I was either fearful, greedy, or not trusting in him and saying, "These are areas you can surrender and trust me." So I would say looking back, it's been a really joyful journey, but for me, it wasn't always joyful at the beginning. But now I'm free of anxiety and worry because I've seen I can trust him along the way. Jason Montoya (42:10) Yeah. Yeah, yeah, yeah. There's something about letting go. When we get into trouble and it's our fault, it's one thing, but if God steers us... I'm curious, you mentioned greed. Dana Wichterman (42:37) Exactly. Jason Montoya (42:45) In America, I think we probably have a lot of greed. Maybe we want to dismiss it. We're so wealthy, but because we live in America in a bubble, we don't necessarily see how wealthy we are compared to other parts of the world. What would you speak into both how wealthy we are and how greed plays a part? Bill Wichterman (43:15) Yeah, that's a really great point. It goes to a really important point of living below your means. Dana talked about the eighth wonder of the world being compound interest according to Albert Einstein. The ninth wonder has got to be "live below your means." Because if you can learn to spend less than you earn, you will quickly see the joy and the freedom that comes from having a surplus. This is why Proverbs talks about the importance of being like the ant that stores up, not like the grasshopper that eats everything right away. I think we kind of look around at other people and we tell ourselves, "Well, we have to do it this way." I remember some people we knew who were facing incredible possible bankruptcy and just heavy debt. And they went to Disney World on vacation. And they said, "Well, you gotta go on vacation." Where's that written that you have to go on vacation to Disney World, right? Jason Montoya (44:11) Yeah. Bill Wichterman (44:11) And I think we tell ourselves that we need things that we don't need, and you can adjust. It does require self-discipline. It does require giving up some of your natural desires. But my goodness, I remember when I was fired at one point—never something you want to face. I thought that would never happen to me. It did. But we had savings because we had been able to save about 10% a year for the last seven years. This was early on in our marriage. And we looked at it and we were like, "Yeah, we can go for a year." I didn't want to be unemployed for a year, and I wasn't, but it wasn't catastrophic. It wasn't like, "My gosh, how many days do I go till I'm really in big trouble?" So I think part of it is get your blinders off and look at how most of the world lives and know that you are among the wealthiest people in the world if you have a household income of $74,000 a year, which is the median household income in the US. That makes you rich worldwide. Jason Montoya (45:22) I would like to get your thoughts on the other extreme: the hoarding side of it. I once met a guy who lived well below his means. He made a few hundred thousand a year and lived on 30% of it. And I asked him one day, "If you just lost your job and you couldn't get any money, when would you run out of money?" And he was thinking about it and said, "I think about ten years." And then I was like, "Well, what are you worried about?" Because he just seemed worried about money. So I think that's the other extreme. Dana Wichterman (46:02) Well, I have a tendency towards hoarding. Jason Montoya (46:16) Yeah. Dana Wichterman (46:16) And I think it is because I think too many "what ifs." I need a lot of contingencies and a lot of safety nets. And what I've learned is there are some safety nets that are prudent, right? But if you have too many, it says something about you. It says that you're trusting in your barns. You know, that parable of the guy who got a huge harvest, he built his barns, and now he can relax and enjoy. It's like, no, you can't trust in those things. So yes, be prudent. It's a tension between living like the ant, saving up correctly, and then not being a hoarder either. Hoarding would be saying, "I need these things to keep me safe." Jason Montoya (46:32) Stacks up. Dana Wichterman (46:32) And long-term planning savings is, "How am I storing those for my needs, my family's needs, and for what God wants me to do in the world?" I would imagine hoarders, if they're all nervous about it, they don't have a plan for those resources. If they had a plan, then they would be on a mission. There's a reason they're living on 30% of their income—it's because they're trying to deploy those resources for God's kingdom. But if they're only deploying it for their safety, we know that you can never have enough to be safe in this world. Jason Montoya (47:37) Yeah. Bill Wichterman (47:38) In 1 Timothy 6, Jason, it says, "Command those who are rich in this present world not to be arrogant, nor to put their hope in wealth, which is so uncertain, but to put their hope in God who richly provides us with everything for our enjoyment." So that notion of putting your hope in riches, it's really easy to do. One of the couples that we highlight in our book, they were billionaires for a time. And we asked this couple about where Jesus said, "the deceitfulness of wealth chokes out faith" when he's talking about the parable of the sower. So we asked him, "What is it that's deceitful about wealth?" And without missing a beat, Dennis Bakke said, "The illusion of control." It's that thought that "I'm protecting myself. Nothing can happen to me." That's an illusion. Jason Montoya (48:33) Yeah, that's the word: control. I imagine as a billionaire, you can control more things, but even then you realize how much you can't control. I guess the great equalizer is death, right? None of us can skirt that. Bill Wichterman (48:55) It's really true. Jason Montoya (48:58) What else would you guys want to share that you haven't? Bill Wichterman (49:01) I have one, Dana, if I could jump in. The importance of keeping track of your spending. I think a lot of people don't really know where their money goes. And if you keep track, which has become ever easier with all these great programs out there—we use Quicken, I know there's a whole bunch of programs—if you have a credit card or debit card, you can electronically download it to one of these programs, and it will assign a category. Then you just go through, and in about 10 minutes, you look at all your expenses in the last week and you make sure that everything's properly assigned. Boom. Within three months, you have a great record of your expenses and you might be shocked to find out how much money you're spending at Starbucks. Jason Montoya (50:03) Yeah. What would you add to that? Dana Wichterman (50:09) Yeah, I would add to do some of your discerning of how you're going to manage your resources in community. I think it's because we tend to lie to ourselves, and self-deceit is so easy, particularly with money. And so if you know that you're going to open your books to other people pretty transparently and say, "Do you think I'm following what the Lord would have for me? Do you think I am doing the right thing with this?" Just that transparency itself is a powerful force, but it also means you can celebrate with others too. I don't want to be a giver that's doing it just out of guilt. No, you can celebrate with other people too. Jason Montoya (50:54) Yeah. Dana Wichterman (50:54) I would say, try to find the right person who's safe and isn't going to judge you, but they're just going to help you and encourage you along the way of your stewardship and generosity journey. Jason Montoya (51:12) Yeah. So if someone's hearing this, what are the best ways for them to connect with you or find out more? Bill Wichterman (51:16) stewardsnotowners.com. That's www.stewardsnotowners.com. And there they'll see book excerpts, interviews with some of the people in our book, and a plethora of resources of other things they could read. You could also buy our book, Stewards Not Owners: The Joy of Aligning Your Money with Your Faith. You can buy it on our website, you can buy it on Amazon, on Barnes & Noble, Simon & Schuster, it's in all kinds of places. We have an audio form, we've got it on Kindle. Jason Montoya (51:47) They did not steward their business well. Bill Wichterman (51:51) Ours is not the only good book on stewardship. We love Crown Ministries; they have all kinds of great free resources on their website. So lots of things out there to do. We're not trying to figure out how to sell books. By the way, whatever we make from our book, we give that away anyway. We're really just trying to invite people into this joy of stewardship. Jason Montoya (51:57) Okay. Jason Montoya (52:23) Yeah, now is it worth talking about the organizations you're a part of? Dana Wichterman (52:29) I would say look at faithdriveninvestor.org if you want to start on this journey of how to align your investments with your faith. Lots of free resources, podcasts, and small groups for other people that are on this journey. Great resources there. And then if you're interested in starting some kind of mini endowment for your own family's charitable giving, there are two places. There's the National Christian Foundation, which is a wonderful donor-advised fund if you want to work mostly with nonprofits. And then if you want to invest some of that charitable money into transformational for-profit companies, then you could come to impactfoundation.org. That's another donor-advised fund that works very closely with the National Christian Foundation for what we call Impact Investing. Jason Montoya (53:24) That makes me think of one other thing I would like to ask. I have a coaching client I work with. His kids are older, high school graduation age. He wants to figure out ways to use their money as a family, investing in things together and in business endeavors. Do you have any thoughts on that? Bill Wichterman (53:46) We've not done family investing. We know that there are people who do that, who kind of bring that all together. I don't know if we've gotten our kids enough to that place. Dana, you look like you're going to say something. Jason Montoya (53:58) Ha. Dana Wichterman (53:59) Well, if he's talking about family giving, there are all kinds of ways you can get your kids involved. Like, "Okay, we as a family are going to give away X amount, $5,000 this year. And we are all going to talk about, pray about, and think about one place." You might go to a ministry and say, "We have $5,000, can you give us three different options that your ministry would benefit from?" And then we as a family are going to pray about it and decide. So that's a real tangible thing that you can do. For investing, again, I've seen families do impact investing. That usually takes a minimum of $25,000. But for families who want to do that, contact us at impactfoundation.org and we can certainly give you some training materials in ways that families, especially multi-generational families, can train the next generation to manage those resources well. Jason Montoya (55:02) Yeah. Yeah, part of the catalyst for him talking about this was he saw his parents retire and then kind of live their life for themselves. And he's saying, "I want to do something different than that." Dana Wichterman (55:30) Yeah, yeah. Well, even some of these companies like Masaka Creamery and others, they take investment, and sometimes you can do as small as a $5,000 investment. There are ways to do that as a family, and then you might want to go visit. We went and visited the cashew company in Mozambique as a family six years ago or so. That was hugely transformational for our kids. It's called Sunshine Nuts. Jason Montoya (55:59) Okay. How would someone get involved in something like that? Dana Wichterman (56:01) Well, they'd have to contact the founders and find out. We said, "We'd love to come out and visit your company and see what you do." So they took us through their factory. They were kind enough to have us in their home for a few days. But there are a lot of these companies in Africa that you can visit if you're interested in investing. Jason Montoya (56:05) Okay. Dana Wichterman (56:31) Go to faithdrivenentrepreneur.org and see what some of these companies overseas are doing and see if you can visit some of them. Usually, they're raising some kind of capital, either equity or debt, that you can participate with. Jason Montoya (56:51) Okay, cool. Yeah, that's interesting. Bill Wichterman (57:01) We could talk all day, but the point is, don't be afraid. Start with a single prayer and just say, "Lord, own me and you own everything I have. Help me to learn how." Jason Montoya (57:14) Yeah. Well, Dana and Bill, thank you for joining me on the Share Life Podcast. Dana Wichterman (57:16) Thank you, Jason. Bill Wichterman (57:20) Thanks, Jason.